Gynecological Devices Market Size, Share & COVID19 Impact Analysis | Global | 2021-2027 | MedSuite | Includes: Assisted Reproduction Technology, Endometrial Ablation, Gynecological Resection, Uterine Tissue Removal, Uterine Fibroid Embolization, Hysteroscope, Colposcope, POP Repair & Fluid Management Devices

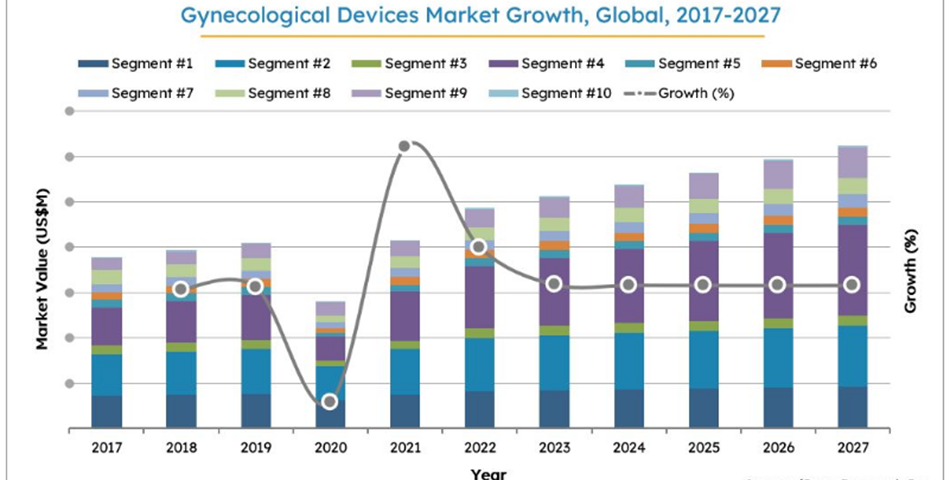

In 2021, the global gynecological device market size is projected to reach $2.1 billion, with mechanical uterine tissue removal devices showing the fastest growth in demand. In spite of COVID19, the global market size is expected to increase over the forecast period and exceed $3.3 billion in 2027. Currently, the majority of the global market share is controlled by three main companies – Hologic, Cooper Surgical, and Boston Scientific.

One major trend in the global market for gynecological devices is the shift towards mechanical uterine tissue removal procedures and away from alternative and more dangerous treatments. The purpose of mechanical uterine tissue removal devices is to remove uterine growths or the uterine tissue, while protecting the uterus’ integrity to prevent consequent issues, such as infertility. The use of a wand instead of a blade avoids dangerous cuts to the uterine lining/tissue.

Concerns over the safety of pelvic organ prolapse devices are expected to hinder market growth over the forecast period. In Europe, transvaginal meshes are recommended to be used only in complex cases where there are no other alternative treatments. The lawsuits, regulatory scrutiny, and general poor publicity regarding the usage of meshes are likely to limit growth in the pelvic organ prolapse repair market and the overall market.

HOW MANY UTERINE TISSUE REMOVAL DEVICES ARE SOLD GLOBALLY?

Globally, there are over 320,000 uterine tissue removal devices are sold every year, with the United States and China having the highest product demand.

Over the next 6 years, the number of these devices sold will grow exponentially, reaching over 1 million devices sold in 2027. The popularity of mechanical uterine tissue removal devices is projected to continue growing due to the procedural time efficiency they provide. Thus, this market study analyzes how these devices are disrupting the global market, including the impact on the gynecological resection device market segment.

HOW’S COVID19 IMPACTING THE GYNECOLOGICAL DEVICE MARKET?

In 2020, the global market for gynecological devices declined by over 30% when compared to 2019 as a result of the COVID-19 pandemic. However, the global market is expected to recover rapidly and reach the pre-COVID levels by the end of 2021.

The gynecology market was severely impacted by COVID-19, as the majority of gynecological procedures are considered elective. For example, in the assisted reproductive technology (ART) market, the majority of countries stopped treatments with the exception of fertility preservation for oncology patients. Most countries restarted treatments following the easing of lockdown restrictions. Restarting ART treatments was seen as a priority in most countries due to the time-sensitive nature of infertility and the long-term impact this could have on population growth.