According to Euromonitor International, the consumer health market in Germany remains highly fragmented. The market is characterized by a high level of innovation and a significant number of new players entering the market.

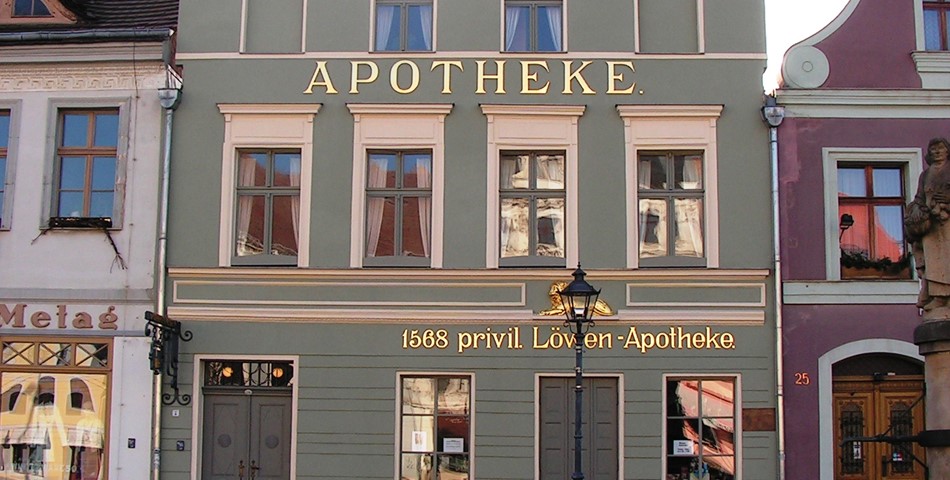

In 2017, chemists/pharmacies remained the leading distribution channel in consumer health in Germany. This can be explained by the restricted access to various OTC products, and the highly valued professional advice consumers receive at pharmacies, related to different health issues.

GTMHC reports Germany has one of the densest healthcare providing structures of the world, consisting of general practitioners, medical service centers, hospitals and rehabs. At a population of 81 million, there are more than 17 million hospital cases per year and about 1.3 billion outpatient physician contacts per year.

The restructuring of hospitals and health insurance companies is producing institutions with stronger capital structures. The number of specialized private hospitals is growing, so is the demand for highly specialized and innovative product solutions.

In Germany, innovation and technical knowledge is high. Within the healthcare sector, the focus is changing from cost savings to market orientation and patient care. There is a strong need to modernize and renew the healthcare supply structure.

Within the healthcare market, the pressure on innovation grows while there is an increasing gap on investment. Public and decision makers are becoming more and more aware of this. Interesting areas for investors are biotechnology, medical technology, telemedicine, digital health and health IT. For example, there is an increasing demand for solutions which are making processes easier and more efficient.

Solutions reducing complexity, saving time and cost can help relieve pressure on care and medical personnel. The point of human resources is often discussed from both the supplier and consumer point of view.

Innovative solutions are also encouraged for enhancing workflow optimization. German market biotech dedicated to medical/life sciences is valued at $1.6 billion with around 300+ local players, according to export.gov. In addition, most pharma giants such as Bayer, Merck, Boehringer and U.S. subsidiaries (Pfizer, Amgen, etc.) have their own biotech development in pre-clinical pharma and also license in/out.

There are good opportunities for biotech startups/SMEs to seek partnerships with large pharma in Germany and incubator/accelerator partnerships. The disparities of medical services in rural and urban, central and periphery areas, remain a challenge in Germany, urging production focus on telemedical solutions as well as ambient assisted living (AAL).

Secure data transfer and connecting medical service providers and disciplines are ongoing discussions, as well as ehealth’ requirement for data secure health mobile apps. The German hospital structure is diverse. The market is shared by public, private and non-profit, mainly church supported trusts. The big hospital chains have the tendency to centralize the decision making process.

On the other hand, the German pharmacy market was previously regulated to improve health and contain costs for the statutory health insurance, GKV system, yet has experienced part liberalization since 2004.

The market is dominated by private owned pharmacies, yet pharmacy chains with more than three branches are not permitted. While long-term care is dominated by home care (70%), where relatives play an important role.

Ambulant care services and nursing homes are mainly privately owned or non-profit, the structure being diverse with local to nationwide actors.